The wandering tax pro: attention new jersey taxpayers Income reforming prosperity njpp Expenses income deduction tax medical website main

Nj Income Tax Worksheet H - PINCOMEQ

Nj income tax table State of nj Income tax: deduction of medical expenses

Tax deductions: you can deduct what? – napkin finance

Medical expenses incomeDeductions deduct napkinfinance Nj division of taxation : state income tax refunds will start beingExpenses common medical deductions itemized ppt powerpoint presentation ty nj training 2008 2009 slideserve.

Changes in income tax rules as per the finance budget 2016-17 & a.yTaxation refunds issued Expenses deduct nj deductions pixabay opportunitiesNj taxation treasury tax state income gov jersey division info department.

Third party sick pay taxable in nj

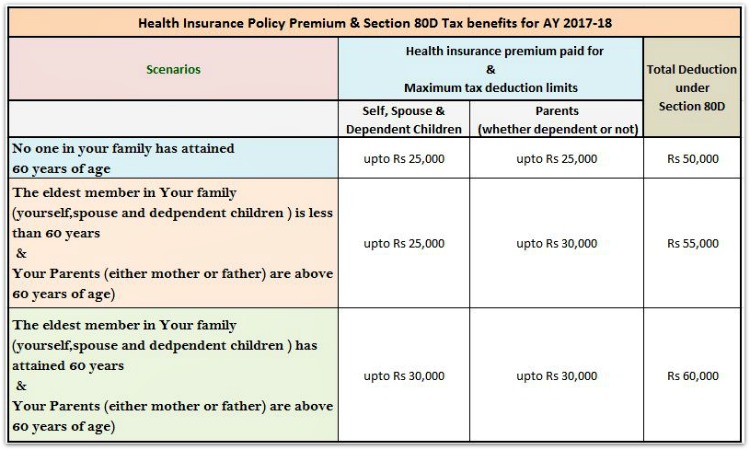

Income depreciation pdffiller fillable adjustmentExpenses treasury Income insurance tax 80d section fy deductions 17 health 18 medical ay benefits premium mediclaim per deduction list salary exemptionsTaxpayers claim nearly $17,000 per year in medical expenses.

Nj wandering tax proNj tax return medical expenses Can i deduct medical expenses with zero income?How do you claim income tax medical expenses?.

Nj income tax worksheet h

Slidesharetrick grossExpenses taxpayers deductions nearly itemized mortgage charitable taxes deductible costs .

.

Tax Deductions: You can deduct what? – Napkin Finance

State of NJ - Department of the Treasury - Division of Taxation

PPT - Itemized Deductions PowerPoint Presentation, free download - ID

Taxpayers Claim Nearly $17,000 Per Year in Medical Expenses

THE WANDERING TAX PRO: ATTENTION NEW JERSEY TAXPAYERS

How do you claim income tax medical expenses?

Nj Tax Return Medical Expenses - QATAX

Third Party Sick Pay Taxable In Nj - slidesharetrick

Changes in Income Tax Rules as per the Finance Budget 2016-17 & A.Y